Friday Reflection | April 23, 2021

We are constantly filtering information. Globalization of our economies and several decades of innovation and technical development have brought us 24/7 news cycles, troves of information in the palm of our hands, and a generally accelerating pace of life. Sometimes energizing and other times exhausting, this abundance of data creates both opportunity and obstacle.

One method of gaining perspective when faced with overwhelming data is to zoom out and understand how recent activity fits into a larger pattern. By doing this, we can gain a better understanding of the ‘relative progress’ during the pandemic versus the ‘absolute progress’ over a longer timeframe.

This week, the S&P 500 experienced choppy trading and sideways movement, ending virtually unchanged. In investors’ minds, stronger than expected corporate earnings announcements were overshadowed by short-term data showing an acceleration of global COVID cases, with alarming hot spots in India and Germany.1 If we zoom out further, we can see that this relative market weakness contrasts with a nearly 51% increase in the S&P 500 over the past 12 months.2 This time period is key to that eye-catching number. Last April the shock of lockdowns and school closures was still setting in, and the first round of stimulus had barely been announced. Since that time, investors have bid prices up on the trifecta of government support, election certainty, and vaccine progress, content to participate in the market while awaiting economic recovery. This has been a period of investor optimism.

If we zoom out even further, the cumulative three-year growth of the S&P price index is barely higher than the one-year number – meaning there was effectively no price growth from April 2018 to April 2020 due to trade war friction, rising interest rates, and pandemic price erosion, prior to the substantial price increase of the past year. Each timeframe provides a different perspective on the pattern of growth and helps us to meld the varied narratives in our understanding of portfolio risk and market expectations.

The Pandemic Era

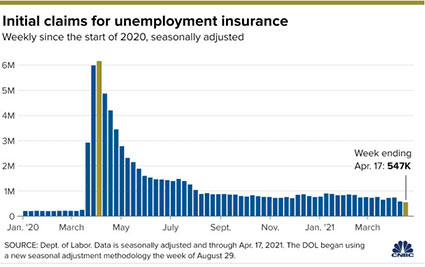

In tracking the economic recovery, one example of a balancing act between short-term progress and long-term perspective comes in unemployment data. Per the Labor Department’s weekly report, 547,000 people applied for unemployment benefits last week. While that may sound like a large number, it is the lowest weekly amount of people filing unemployment since March 14, 2020. As the headlines proudly tout, it is “a new pandemic-era low”.

This concept of measuring and comparing within the “pandemic era” is a way of celebrating the progress we’ve made since the onset last March. It also distorts data to create favorable comparisons. Significant progress has been made since jobless claims reached a staggering 6.2 million in April 2020 in the initial days of the economic shutdown. That spike obliterated the previous weekly record high of 695,000 set in October 1982.3 On a relative basis, we’ve gotten a tremendous amount of people back to work. On an absolute basis, the current level of weekly unemployment claims is barely below the pre-pandemic record high, making it clear we still have a long way to go.

This concept of measuring and comparing within the “pandemic era” is a way of celebrating the progress we’ve made since the onset last March. It also distorts data to create favorable comparisons. Significant progress has been made since jobless claims reached a staggering 6.2 million in April 2020 in the initial days of the economic shutdown. That spike obliterated the previous weekly record high of 695,000 set in October 1982.3 On a relative basis, we’ve gotten a tremendous amount of people back to work. On an absolute basis, the current level of weekly unemployment claims is barely below the pre-pandemic record high, making it clear we still have a long way to go.

Approximately 4 million fewer Americans are at work than before the pandemic. The national unemployment rate remains at 6%, well off the pandemic high of 14.8% but still considerably above the 50-year low of 3.5% level just before the pandemic shutdown.4 Zooming out highlights that the economy is far from healed, but for now, economic reopening and strong consumer demand are fueling continued employment recovery, which in turn is supporting equity prices.

ESG Brings Welcome Nuance

Social and environmental trends exhibit less of a direct link to market performance than corporate earnings, but growing consumer and investor attention has increasingly prompted these issues to be considered in corporate strategy. At this temporal intersection of the economy and social concerns, a guilty verdict arrived this week in the Derek Chauvin trial. Similar to our above commentary on time perspective, we applaud short-term progress and justice in policing, a pernicious area of racial inequality. Nonetheless, we also acknowledge the difficulty of long-term progress in the larger arc of change in racial equity.

On the climate justice front, more than 190 countries celebrated Earth Day this week.5 In the fifty-one years since Earth Day began, helpful environmental policy has both waxed and waned. It is easy to be excessively pessimistic, for example during the Trump presidency when we withdrew from the Paris Climate Accord and opened up previously protected lands and waters to oil drilling. It is also easy to be excessively optimistic as key environmental voices trumpet the expansion of clean energy and regenerative agriculture, while simultaneously warning of the longer-term arc of rising temperatures and shifting weather patterns.

Over the longer term, we expect to see this linkage between social issues and financial performance become stronger. This evolution of corporate practice brings welcome nuance to financial analysis generally, and as we navigate ESG portfolio management, highlights a longer-term perspective on progress for our shared economy.

The Perspective That Matters Most

No historical period offers a perfect roadmap of what comes next in the current market. Geopolitics, tax law, technology, and the compounding scale of the global economy are constantly changing. The pandemic reminded us that there are risks that we aren’t even contemplating that could change the pattern of growth in unknowable ways. Regular rebalancing helps smooth this cycle of risk and growth, and when combined with diversification is a far more reliable strategy than the hubris of market timing.

The market swings last March highlighted the personalized nature of investing. Some of our clients were able to add money to their long-term portfolios, some clients needed to shift to be more conservative and raised cash levels, but the vast majority rode through the storm (in conversation with us) because their financial life had not materially changed. The storm passed, and portfolios recovered. For virtually all of our clients, life events are more meaningful metrics to guide financial decisions than shocking changes in unemployment, GDP, or equity market prices. Family, career, health, philanthropy – these are the true directional markers that provide perspective.

Many new metrics have emerged as a result of pandemic disruptions. We have adjusted risk targets with some of our clients. Lenders are tightening credit and lending standards. Vaccinations have continued and venues are reopening with attentiveness to capacity metrics. History provides context, and emerging innovation will lead the way through the unknown challenges ahead. The world is recalibrating based on new realities, and portfolios will similarly adapt as our clients navigate both the planned and off-script evolutions in their own financial lives.

1 Global Covid-19 cases have increased by more than 5.4 million over the past week, according to data from Johns Hopkins University. That’s a record for a seven-day period since the start of the pandemic, and more than double the weekly rate of confirmed infections as recently as in mid-February.

2 S&P 500 price return for period of 4/22/20 – 4/22/21. Yahoo! Finance

3 US Jobless Claims CNBC

4 Civilian unemployment rate US Bureau of Labor Statistics

| About Brian Kozel, CFP®Brian is a partner, senior advisor, and Chief Investment Officer at North Berkeley Wealth Management. Brian helps clients feel confident as they navigate their financial journey. |

This commentary on this website reflects the personal opinions, viewpoints, and analyses of the North Berkeley Wealth Management (“North Berkeley”) employees providing such comments, and should not be regarded as a description of advisory services provided by North Berkeley or performance returns of any North Berkeley client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data, or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. North Berkeley manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.