Friday Reflection | July 24, 2020

Space Race 2.0

Recent weeks have brought concerning news about surging virus cases and deaths in the United States, an uptick in unemployment claims, and continued gridlock on critical stimulus negotiations in Congress. And yet, the US stock market ticked higher. The eyes of the world, including those of investors, remain fixated on the hopes of a vaccine and each incremental announcement of progress. This week’s news was that the United States put in a preemptive vaccine order for almost $2 billion to Pfizer and its German partner BioNTech. This vibrant anticipation of a cure-all that could return us to a world of unfettered consumption and mobility has overshadowed more sobering economic and corporate earnings data.

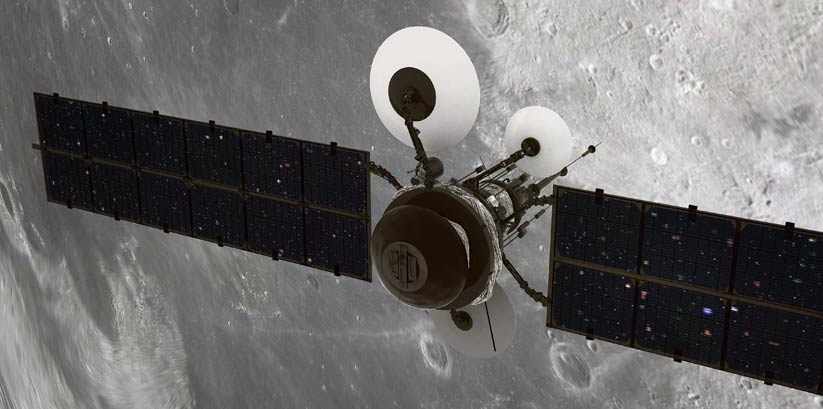

An eventual announcement of a successful vaccine would be a captivating and victorious moment akin to the US landing on the moon on July 20, 1969. The path to this medical achievement appears similarly wrapped in tense geopolitical competition and uncertain timelines, and patience will be required of investors even if the research cycle is substantially shorter than the US-Soviet space race that spanned more than a decade.

Protection, Productivity, and Prestige

While the outcome of Cold War rivalry arguably had worldwide consequence, it is unequivocal that this fight against COVID-19 has global implications. The virus has accounted for more than 630,000 deaths so far, and halted many aspects of international trade and travel. The nation that is first to develop a successful vaccine will have relief from the virus, as well as reigniting their economy and affirming their status as a center of biotech innovation in the modern age.

“The vaccine is partly about health, but it’s absolutely equally as much about getting our engine of productivity back,” says Lawrence Gostin, a professor of global health law at Georgetown University Law Center. “If China had it and we didn’t, their economy could hum, and ours would continue to be in social distancing lockdowns and disruptions. This has economic, political and public health consequences [1].

This pursuit of technological leadership, and the pedestal for economic and ideological influence that accompanies it, drove overwhelming investment into research and development in the first space race. National pride and security concerns slowed progress by limiting international collaboration, but simultaneously provided the political willpower for substantial investment of capital. These same nationalist forces exist today. The United States has launched Operation Warp Speed, investing billions across a wide range of biotech and pharmaceutical companies developing vaccine trials. China has stated the goal of becoming the world leader in biotech and has put the full weight of the state behind the country’s vaccine candidates. France reached an agreement with pharma giant Sanofi to ensure initial vaccine successes would be provided to French citizens. The UK is touting the progress being made by the Oxford-AstraZeneca collaboration [2]. These diverse research efforts may hasten the discovery process, but, like the attempts to put humans into space, the path to a breakthrough vaccine isn’t guaranteed to align with timelines proclaimed by politicians.

Many people in biotech and public health worry that the kind of cooperation necessary to beat COVID-19 is being undermined by the hunger of certain national leaders for bragging rights, and general refusal to endorse a global response. Recently, the United States, Russia and India all refused to join a WHO initiative to promote collaboration in the development and distribution of coronavirus vaccines and treatments. This modern “vaccine nationalism” poses a risk to investors’ expectation that discovery of a vaccine will swiftly support global recovery. Ideally, better collaboration will emerge when a vaccine is found. Even at the height of the Cold War, an American was allowed to conduct extensive and successful polio vaccine trials in the Soviet Union because the fear of that virus was greater than political differences [3].

Corporations have already taken steps to ensure their ability to produce – and therefore profit from – a vaccine regardless of national policies. Examples include Johnson & Johnson building out manufacturing capabilities in the United States, Europe and Asia. Pfizer is partnering with a German firm to establish manufacturing capabilities in the United States and Belgium, and Moderna is expanding beyond their factory in suburban Massachusetts to partner with a Swiss manufacturing firm to scale up production in Europe [4]. Global collaboration has been proven to work, if politicians allow it [5].

Collateral Innovation

The political motivations driving the space race of the late 1950s and 60s ultimately dissipated, but the research completed during that time laid the groundwork for advancements in other areas of technology. This is the underappreciated legacy of the Cold War, and represents a potential silver lining for investors and progress in coming decades.

The pursuit of putting humans on the moon allowed collateral innovation to blossom. As a direct result, we now have vast satellite networks that allow continuous broadband communication, accurate weather forecasting, and the ability to GPS track your deliveries all the way to your doorstep. Not to mention advancements in artificial limbs, anti-icing systems that allow aircraft to safely fly in cold weather, LED lighting, and the invention of smoke and carbon monoxide detectors [6].

If current investments in vaccine research lead to advancements in biotechnology, the health benefits – and returns to investors and society – could be substantial. They could give birth to new companies or solutions, and like the innovations listed above, the progress is not limited to any one industry. The production of a safe and effective vaccine would have more immediate benefit than landing Apollo 11 on the lunar surface, and would similarly create a foundation for growth in the next phase of technology expansion and societal evolution.

Patience and Commitment

Right now, the COVID virus is distorting countless facets of life, but history shows us that the human capacity for innovation is remarkable. Longtime portfolio manager at First Eagle, Matthew McLennan, often says that “the US does not have a monopoly on good businesses” and the same is true for medical research and innovation. Despite recent technology sector outperformance from US-based FAANG stocks, we think there is a strong case for international diversification in our decidedly global world.

As geopolitics ebb and flow between global cooperation and bouts of nationalism, the investors who have patiently remained committed to high quality companies and continued innovation have been financially rewarded. We expect a similar outcome with today’s efforts to restore public health globally, and revitalize economic activity. As stewards for our clients and their financial resources, we are patient in the face of an unknown timetable, and committed to investment in innovation.

[1] The global race for a coronavirus vaccine could lead to this generation’s Sputnik moment. By Carolyn Y. Johnson and Eva Dou. June 3, 2020. Washington Post

[2] The Dangerous Race for the COVID Vaccine. By Elizabeth Ralph. July 7, 2020 Politico.com

[3] Smithsonian National Museum of American History. Two Vaccines, Sabin and Salk. Polio Vaccine During Cold War

[4] Even finding a covid-19 vaccine won’t be enough to end the pandemic. By Christopher Rowland, Carolyn Y. Johnson and William Wan. May 11, 2020 Washington Post

[5] In 2017, an Ebola vaccine was discovered by Canadian researchers, licensed to an American biotechnology company, who partnered with one of the world’s biggest pharmaceutical companies to produced the vaccine in Germany.

[6] Northrup Grumman and the JPL (Jet Propulsion Laboratory) have chronicled how technology from that time has changed our modern world.

This commentary on this website reflects the personal opinions, viewpoints, and analyses of the North Berkeley Wealth Management (“North Berkeley”) employees providing such comments, and should not be regarded as a description of advisory services provided by North Berkeley or performance returns of any North Berkeley client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data, or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. North Berkeley manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.